What are the best anti-fraud software?

Here are the best anti-fraud software to consider.

1. Mount.

Best anti-fraud package.

Kount is the best global anti-fraud software because it offers a comprehensive solution covering all the necessary bases.

Through digital fraud and consumer information, Kount can provide a comprehensive business solution.

Across a variety of industries, Kount has an excellent reputation and is one of the most popular anti-fraud software solutions, helping businesses identify and prevent fraud.

Thanks to advanced AI with supervised and unsupervised machine learning, Kount can offer a high level of protection.

If you want to control the level of risk your business takes while ensuring growth, Kount is a great option to consider.

Features

- Block fraud on new accounts so you can protect your business from the start.

- The coupon and promotion abuse feature helps to reduce fraudulent activities related to special offers.

- E-gift card fraud is eliminated, so customers can use this payment method with confidence.

- Digital payment fraud is stopped outright, ensuring the safety of your business and your customers.

Pricing

Schedule a meeting with their sales team to review your fraud protection plan.

Strengths

- Numerous functions for verifying a customer's chargeback history are available.

- The time spent preventing fraud, which can be spent growing the business, can be significantly reduced.

Improvement points

- The platform is very powerful and some of its functionalities are very complex, which involves a slight learning curve.

What's new

- Enhanced policies and operations keep you informed and in control.

2. ClickGuard.

Best for protecting Google ads.

ClickGuard is a great anti-fraud software for businesses that advertise with Google Ads.

Since fake clicks are a big problem for many businesses, ClickGuard offers a solution that helps businesses save money while protecting them from fraud.

With a data-driven approach and machine learning, ClickGuard can identify and block fake clicks with high accuracy.

The platform is also equipped with highly customizable technology so that businesses can adapt it to their specific needs.

If you want to stop paying for fake clicks and have better control over your Google Ads spend, ClickGuard is a great option.

Features

- Full control and transparency of your Google Ads spend

- Eliminate wasted clicks to focus on quality traffic.

- Data on the go thanks to an easy to use mobile application

- Increase your return on investment in customer acquisition by making your investment more profitable.

Pricing

Three pricing plans are available:

- ActiveGuard: 59

- PremiumGuard: 79

- EliteGuard: 99

All of these items are paid monthly.

Strengths

- The ability to control and stop click fraud on Google ads works well.

- The platform improves click data by eliminating the waste of clicks.

Improvement points

- Putting the rules in place can be daunting at first.

What's new

- PPC agency fraud protection is now available for businesses of all sizes.

3. Sift.

Best for active fraud blocking.

Sift is able to quantify the damage that could result from fraud and offers a comprehensive solution to protect businesses.

With features such as user behavior analysis, anomaly detection, and machine learning, Sift can offer a high level of fraud protection.

If you want to minimize risks and optimize revenue, Sift is a great option, as it helps prevent online abuse from a single interface.

Sift allows you to actively block those who pose a risk to your business while protecting customers who could be caught in the crossfire.

You can also do this by reducing manual entry, thanks to the various automation processes offered by Sift.

Protect every interaction with your customers and keep your business safe with Sift.

Features

- Dashboards and analytics allow you to analyze and visualize the data needed to take action.

- World-class support is always ready to help.

- Trust and security experts help you understand and stay up to date with the latest fraud trends.

- Streamline operations by automating a large part of manual processes.

- Develop the business by confidently opening up to new markets

Pricing

Request a demo to see the pricing plans offered by Sift.

Strengths

- All the data is right in front of your eyes and easy to search, making it easy for you to take action.

- Information is both accurate and provided in real time.

Improvement points

- Linked accounts are not always displayed immediately, so you have to get used to it.

What's new

- Sift has launched a new API and connectors to help streamline payment for online purchases.

4. LexisNexis.

Best for email intelligence.

Email intelligence is a crucial method for fraud prevention, and LexisNexis is an excellent platform that offers this service.

Emailage uses data points related to an email address to establish a risk score, which can be used to prevent fraud.

This approach makes it possible to effectively combat account takeovers, payment fraud, and other types of online fraud.

Customers want a secure solution for online transactions, Emailage is a great way to ensure your business is protected.

Give your customers the confidence that their transactions are protected and that you are using the latest fraud prevention technology.

Thanks to its various options that can help you verify the identity of a consumer while ensuring a positive experience, Emailage is an excellent choice for fraud prevention, especially that carried out using fake email generators.

That is why it has quickly become a reference for businesses that want to integrate email intelligence into their fraud prevention strategy.

Features

- Identify and prevent fraud in all types of transactions

- Measure the risk associated with email addresses in real time

- Increase sales by reducing false positives and friction at the checkout.

- Make safe and effective decisions with global data coverage

- Use with other LexisNexis Risk solutions to create a 360-degree view of risk.

Pricing

Request a free demo to see how Emailage works and what the interface looks like.

Strengths

- Cloud software allows you to always use the latest version.

- Emails are well-organized and easy to review.

Improvement points

- The lack of user types that you can set up (as well as the various permissions) makes it difficult to give access to certain people in specific roles.

What's new

- Instant validation by email at the time of the quote allows businesses to speed up the subscription process.

5. NICE Actimize.

Better for banks and financial institutions.

NICE Actimize is an integrated fraud management platform that offers a suite of solutions for businesses of all sizes.

Through various functionalities such as customer risk assessment, pattern recognition, and real-time monitoring, NICE Actimize can offer a high level of fraud protection.

As a platform that continuously adapts to new threats, NICE Actimize is an excellent choice for businesses that want to be proactive in their approach to fraud prevention.

Managing authentication for new and existing customers is also a breeze with NICE Actimize, as it offers various options tailored to your business.

Preventing payment fraud is also critical in today's online world, as it helps businesses reduce chargebacks and losses while ensuring that real customers can still make purchases without a problem.

NICE Actimize makes this process easy to complete.

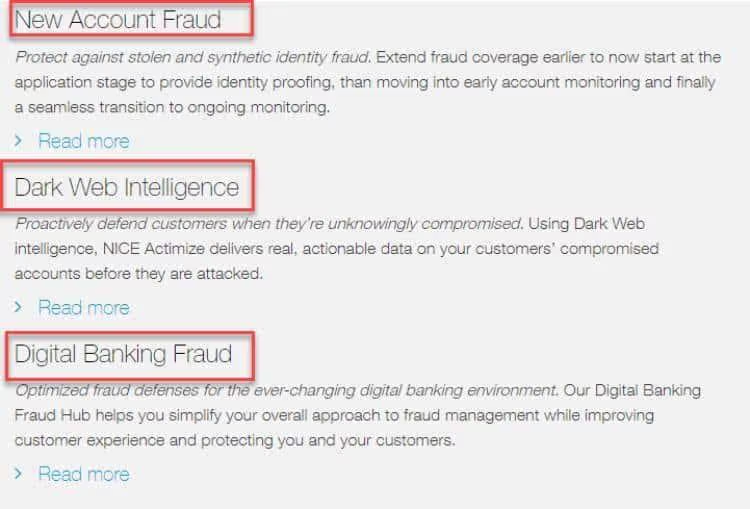

Features

- X-Sight Entity Risk is a great feature that allows businesses to identify and assess risks quickly and in real time.

- Dark Web Intelligence is another great feature that allows businesses to monitor the dark web for compromised data, helping them take action before fraud occurs.

- Digital Banking Fraud is a solution that helps banks and other financial institutions prevent and detect fraud in the digital world.

- Check Fraud is a solution that helps businesses prevent and detect fraud in the physical world.

- Internal Threat is a solution that helps businesses prevent and detect fraud within their organization.

Pricing

Contact NICE Actimize for pricing information.

Strengths

- Actimize is a great application for any banking or financial institution.

- The software is very user-friendly and the customer service is responsive.

Improvement points

- A search with more criteria would be useful for platform users.

What's new

A blend of AI, machine learning, and automation are now combining to provide the next level of fraud detection for the NICE Actimize platform.

6. F5 Distributed Cloud Bot Defense.

Best for API protection.

F5 Distributed Cloud Bot Defense provides API protection for mobile and web applications.

With features like behavioral analysis and real-time threat intelligence, F5 can provide a high level of protection against bots and other automated attacks.

With more and more businesses adopting a mobile approach, it's critical to have a solution that can protect your business against the ever-increasing number of mobile threats.

Traditionally, robot attacks were indistinguishable from human traffic, making it difficult to detect and prevent them.

However, with F5 behavioral analysis, businesses can quickly and easily identify bots and take steps to protect their systems.

Thanks to the various AI algorithms that are constantly learning and evolving, F5 can offer a high level of protection and always up to date from the latest threats.

Additionally, F5 uses a combination of machine learning and human experts to provide real-time threat intelligence, helping businesses stay one step ahead of attackers.

Features

- A converged solution for mobile and web applications helps businesses quickly and easily protect their systems.

- Specialized functions and customer signals help businesses identify bots and take steps to prevent them.

- The AI engine and secure telemetry help businesses stay one step ahead of attackers.

- Adaptive machine learning allows businesses to adapt quickly and easily to new threats.

- Understanding the intent behind attacks helps businesses better protect themselves.

- The closed-loop AI system helps businesses quickly and easily take steps to prevent fraud.

Pricing

F5 offers the following plans:

- Free: $0/month

- Individual: $25/month

- Teams: $200/month

- Organization: Get a personalized quote

7. Ekata.

Best for overall verification.

Ekata is a global identity verification service that helps businesses quickly and easily verify the identity of their customers.

Ensure fraudulent user accounts are not created, while providing a frictionless experience for real users.

You can also use credible data sources to help you make better decisions about who to trust.

Customer authorization is also relatively faster than on other platforms, so your real users can get to work on their tasks more quickly.

By using the Ekata Identity Network and the Ekata Identity Graphic (two exclusive data sets), businesses can verify the identity of their customers with a high degree of accuracy.

If you're looking to detect more fraud while protecting the real user experience, Ekata is a great solution.

Features

- Improve approval rates for real users while reducing chargebacks and fraud.

- Reduce chargebacks and fraudulent requests with manual review queues.

- Avoid revenue losses that may result from fake accounts

- Reduce payment risk and prevent fraud with Ekata's identity verification solutions.

Pricing

Consult one of their specialists to get a personalized quote for your business.

Other anti-fraud software not mentioned in this article includes Signifyd, Riskified, and Fraud.net.

What is anti-fraud software?

Anti-fraud detection is the art of identifying behavior aimed at committing fraud.

The most common way to do this is to look for patterns in the data that correspond to known fraudulent behavior.

To prevent fraud, it is essential to have a solution to protect your business against an increasing number of threats.

Most fraud detection software does this by using machine learning, which is constantly improving and becoming more accurate in this industry.

Businesses must therefore be ready to invest in new software to stay ahead of the curve as they appear on the market.

With the rise in fraudulent transactions and chargebacks, it's more important than ever to have a robust fraud detection solution that helps businesses with their prevention efforts.

Types of fraud

With online and offline fraud detection methods, businesses can protect themselves from a variety of fraudulent activities by knowing what is happening.

With fraud detection tools, businesses can not only detect but also prevent many types of fraud.

Here are some critical types of fraud to consider when buying fraud detection software that can protect you against these threats.

Protection against the takeover of accounts

Account protection as part of a detection and prevention solution is vital for businesses of all sizes.

When a fraudster takes control of an account, they can wreak havoc on the business, including making unauthorized transactions, changing account information, or even closing the account completely.

Fraud prevention solutions that offer protection against account takeovers can help businesses avoid these issues by monitoring suspicious activity and alerting the right person as soon as fraud occurs.

Fraud-related chargebacks

Chargebacks can ruin a business, and they are often the result of fraud.

A fraudulent chargeback can occur when a customer denies having made a purchase, claims that they never received the product, or claims that the product is not as described.

Preventing chargebacks as part of a fraud detection solution can help businesses avoid these issues by constantly monitoring and anticipating specific actions.

Device fingerprint fraud

The credit card isn't the only way to pay for goods and services — fraudsters are constantly finding new ways to defraud businesses, and with the rise of biometrics used to pay for goods and services, that's another area to consider.

The use of behavioral biometrics as part of an anti-fraud solution makes it possible to cover needs in this area.

Fraud in payment transactions

Unauthorized transactions are a big problem for businesses and can happen in a number of ways.

In the case of legitimate transactions, businesses are generally protected by the card issuer, but in case of fraud, the business must assume the full amount.

A transaction risk API connected to your payment processor can help you identify and stop fraudulent transactions before they happen.

Identity theft

With social media data freely accessible, it's easier than ever for fraudsters to commit identity theft.

Online retailers should be aware of fraudsters who use IP spoofing to commit fraud.

IP spoofing occurs when a fraudster uses a proxy server to make it look like they're in another location.

This type of fraud can be prevented by using a blacklist of IP addresses that is updated in real time.

The best fraud detection software focuses on as many of the types of fraud mentioned above as possible in order to provide the best possible protection for businesses.

Characteristics of anti-fraud software

A fraud detection platform requires numerous tools that can be customized to meet the needs of any business.

Here are some key features to consider when buying fraud detection software.

Income protection

While anti-fraud software should eliminate as much fraud as possible, it's also critical that it doesn't block or report too many legitimate transactions.

Reducing the number of declined transactions can help increase revenue and customer satisfaction.

A good fraud detection solution offers a balance between accuracy and risk prevention, and can be customized to meet business needs.

Chargeback protection

We talk about a chargeback when a customer disputes a charge with their credit card issuer.

Chargebacks can be expensive for businesses, and they can also damage their reputation.

A good fraud detection solution has chargeback protection features that can help reduce the number of chargebacks a business receives.

Real-time data enrichment

Reviewing transactions in real time as part of a fraud detection solution can help identify fraudulent activity.

Visualization is critical to any fraud detection solution and should be easy to use and understand.

With data that's updated in real time, businesses can quickly identify and stop fraudsters before they cause damage.

Risk Management

When a business is affected by fraud, it can be expensive.

A good fraud detection solution has features that help businesses manage risks and limit costs.

These can include functions such as fraud risk assessment, which can help businesses determine which transactions to review first.

Malicious software detection

Malicious software is a type of software that is designed to damage or disable computer systems.

Fraudsters often use malware to commit fraud, which can be difficult to detect.

Mitigation is critical to stopping malware, and a good fraud detection solution will have features that help businesses detect and prevent malware.

Receiving the right notifications quickly is critical to stopping malware before it does any damage.

Summary.

Fraud is a big problem for businesses, and it's only getting worse.

Investing in a good fraud detection solution is the best way to protect your business.

With money laundering, chargebacks, and malware on the rise, businesses need to be proactive in detecting fraud.

Additionally, losses due to fraud can add up and cause serious financial damage to a business.

With various SaaS providers offering anti-fraud software, it is essential to choose the one that best meets the needs of your business.

When looking for the best fraud detection software, be sure to consider the features that are most important to your business.

Have you ever been a victim of fraud?

What type of fraud have you experienced?

How did you discover the fraud, and what steps did you take to address the problem?

Let me know in the comments below.

More information: Do you want to protect your business against various threats?

Check out this list of best SIEM tools that provide information and management of security events in real time.

In addition, some of best compliance software solutions help businesses comply with compliance rules.

You can also check out the latest risk management software to ensure that no breaches or attacks will occur under your supervision.

.svg)